Are you in the market for a new home in Canada? One crucial benefit that Canadian home buyers should be aware of is the HST/GST new housing rebate.

The Canadian government, well aware of the problem of housing affordability, introduced the HST/GST new housing rebate as a way to offer a significant refund on new-build homes on the Goods and Services Tax (GST, which is currently 5% in Canada) or the federal part of the Harmonized Sales Tax (HST, which is 15% in all participating provinces except Ontario, where it’s 13%) paid.

But certain conditions need to be met in order to be eligible for the rebate.

What is the HST/GST new housing rebate?

The HST/GST new housing rebate is intended to help qualifying home buyers offset some of the cost of the GST or the federal part of the HST (in provinces that have combined the GST and HST into one tax) that they pay when they buy a home. There are a variety of conditions that must be met in order to claim the rebate.

In general, the key condition is that it must be a new home bought directly from a builder or it must be a substantially renovated home. The reason for this is that usually, you don’t pay GST/HST when buying an owner-occupied home because the property owner is not a builder. You would, however, pay GST/HST to a builder or a contractor who renovated your home.

HST/GST new housing rebate not the same as GST/HST credit

It’s important to note that the new housing rebate should not be confused with the GST/HST credit. The GST/HST credit is a tax-free payment that eligible families and individuals receive quarterly. It’s designed for low- and modest-income Canadians and is intended to help offset the expense of any GST or HST taxes they pay during the previous year.

As of July 2024, the maximum annual GST/HST credit for individuals was $496 and for married or common-law couples it was $650, plus $171 for each child under age 19.

You don’t have to apply for the credit because you’re automatically considered for the credit based on your tax return. As of 2024, the income threshold is $39,000 for individuals, meaning the HST/GST credit starts to be clawed back the more you earn above this threshold.

If you are deemed eligible, a quarterly amount will be deposited in your bank account or you’ll get the credit via cheque.

How do you qualify for the GST/HST new housing rebate?

There are a series of qualifications you must meet in order to receive the GST/HST new housing rebate. The qualifications depend on the type of housing situation:

Owner-built home requirements:

The home is newly built and not a renovation or conversion

The home is your’s or a relative’s primary place of residence

You paid the GST/HST on the land, construction materials and services

The fair market value of the home is less than $450,000 upon completion

Builder-purchased home eligibility

The home is your’s or your relation's primary place of residence

The builder paid the GST/HST on the sale and transferred the rebate to you

The purchase price is less than $450,000 for a full rebate

You have a signed purchase agreement with the builder

The builder certifies that the home is new and not a renovation or conversion

Substantially renovated home eligibility

For a substantially renovated home to qualify, it must meet these requirements:

The home is your’s or your relative’s primary place of residence

At least 90% of the interior has been removed or replaced (some exceptions apply)

You paid the GST/HST on the renovation materials and services

The fair market value is less than $450,000 after renovations are complete

In all cases, you must be an individual (not a corporation or partnership) and the home must be located in Canada. The rebate application must be filed within two years of the home's closing date or substantial completion of renovations.

Why the GST/HST new housing rebate no longer matches the market

With Canada’s average home prices exceeding $700,000 in 2025, many new buyers find the $450,000 rebate limit outdated. The federal government has faced increasing pressure to adjust the cap, though no changes have been made yet. Until reforms are implemented, most rebate benefits are limited to buyers in smaller communities or those purchasing condos.

How can you claim the GST/HST new housing rebate?

To claim the GST/HST new housing rebate, you have to fill out the appropriate rebate application form, which is typically Form GST190 for owner-built homes or Form GST191 for homes purchased from a builder.

You'll have to apply within two years of the home's closing date or the completion of renovations. You also need to hold on to all documents related to the rebate application for a minimum of six years because the Canada Revenue Agency may request them for verification purposes.

Who can benefit from the GST/HST Rebate?

Anyone who builds or buys a new home or substantially renovates their home such that it’s essentially a new house (i.e. 90% or more must be renovated) can potentially benefit by saving thousands, if not tens of thousands, from the GST/HST new housing rebate.

How much is the new housing rebate?

To understand how much you could potentially get as a rebate, it’s helpful to think of the rebate as consisting of two parts: a GST portion and a provincial portion.

You can get up to 36% of the GST (or federal portion of HST) paid on the purchase price to a maximum rebate amount of $6,300 for homes valued at $350,000 or less. For homes over $350,000 and up to $449,999, the rebate is gradually reduced. It reaches zero for homes that are $450,000 or more (note that for the Ontario provincial new housing rebate portion the value of a home could be $450,000 or more).

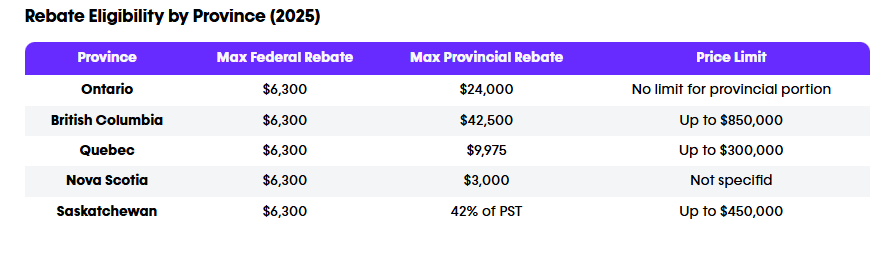

The amount that you can receive also varies by what province you live in. If you live in Ontario, BC, Saskatchewan, Nova Scotia or Quebec, you can also claim an additional provincial tax amount (PST), which varies by province (see below).

Are there any provincial new housing rebates?

As mentioned above, there are some provinces that offer rebates on the provincial sales tax portion of a new home.

Ontario: You can get up to $24,000 on the provincial portion of the HST, even for homes over the $450,000 federal cutoff amount

Quebec: Offers a rebate of up to $9,975 on the provincial tax for homes up to $300,000

Nova Scotia: Has a rebate of 18.75% of the provincial HST up to $3,000

Saskatchewan: Provides a rebate of 42% of the PST on homes up to $450,000.

British Columbia: Has a maximum rebate of $42,500 of the PST on homes up to $850,000

Pair the rebate with the FHSA

First-time buyers can now contribute up to $8,000 annually (lifetime max of $40,000) to a First Home Savings Account (FHSA) — a registered account combining the benefits of an RRSP and TFSA.

Withdrawals used for a first home purchase are tax-free. When used alongside the GST/HST rebate, this can help reduce overall costs significantly.

FAQs

How much HST rebate will I get on new homes in Ontario?

In Ontario, for the housing rebate, you can get up to $24,000 on the provincial portion of the HST, even for homes over the $450,000 federal cutoff amount. You’ll also be eligible to receive up to $6,300 on the federal portion of the HST for a total maximum rebate of $30,300.

What is the GST rebate on a new home in BC?

In British Columbia, the GST rebate on a new home is up to 36% of the GST paid, up to a maximum of $6,300. The province also offers an additional rebate of $42,500 of the PST on homes up to $850,000.

Is there a GST on housing?

Normally if you buy a home directly from an owner you do not pay any GST. However if you buy a new home or condo from a builder you do have to pay the federal goods and services tax (GST) or the harmonized sales tax (HST) in participating provinces on the amount you pay for the property.

What is the new house tax in Canada?

Canada has a new housing rebate, known as the GST/HST new housing rebate. It gives qualifying Canadians up to $6,300 rebate on the federal tax portion of an eligible home purchase or major renovation. Some provinces are also eligible for an additional rebate amount.

— with files from Romana King

Disclaimer

The content provided on Money.ca is information to help users become financially literate. It is neither tax nor legal advice, is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Tax, investment and all other decisions should be made, as appropriate, only with guidance from a qualified professional. We make no representation or warranty of any kind, either express or implied, with respect to the data provided, the timeliness thereof, the results to be obtained by the use thereof or any other matter. Advertisers are not responsible for the content of this site, including any editorials or reviews that may appear on this site. For complete and current information on any advertiser product, please visit their website.

†Terms and Conditions apply.

SOURCE AND FOR MORE INFORMATION: What you need to know about the GST/HST new housing rebate